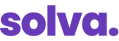

Grow your business through customer loyalty

In today's competitive market, achieving brand loyalty is critical for businesses to survive and thrive. Building a loyal customer base is a trust-based relationship that is essential for long-term success. Therefore, businesses must focus on building strong relationships with their customers to increase retention.

Why Loyalty Program?

A loyalty programs can be a powerful tool for building and maintaining strong relationships with customers, boosting sales, and ultimately contributing to the long-term success of a business

Customer Retention

By offering rewards and incentives to customers, you can build a loyal customer base that is more likely to return for repeat purchases

Boost Profits

By giving loyal customers rewards, they may feel more inclined to shop with your brand which can keep a steady amount of revenue coming into your business

Improve Brand Reputation

When customers perceive that your brand provides them with great value, it can make them feel good when they shop with you.

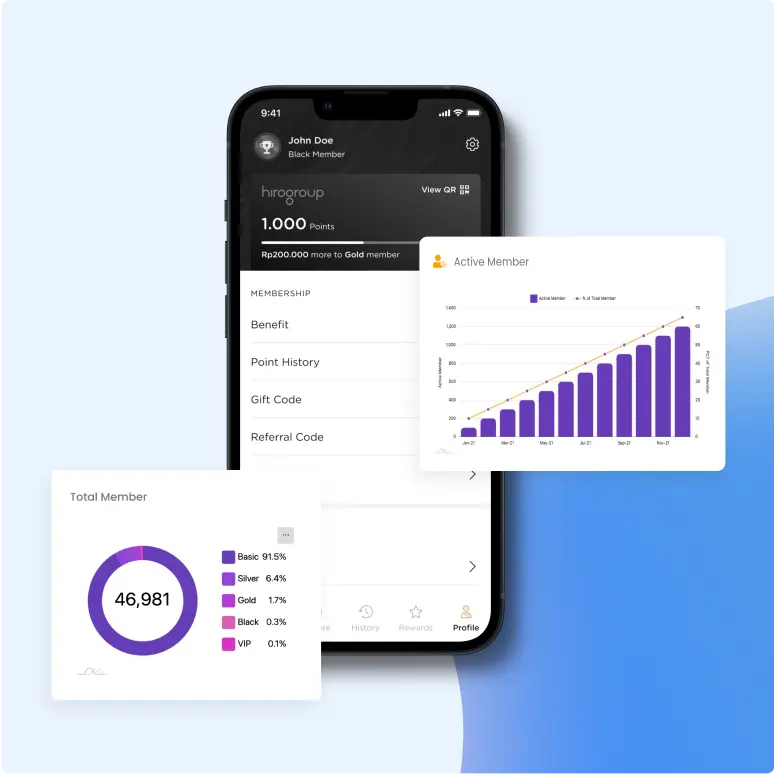

Build Metrics

Easier to keep track of your customers' purchases and spending habits.

Grow with us

By teaming up with us, you'll use our knowledge, innovative ideas, and technology to make a loyalty program that gets customers involved, increases earnings, and improves your brand's connection with our team. Let's collaborate to create a program that delight customers and takes your business to higher levels.

Experience Matters

We have a wealth of experience in our field

Custom Solutions

We offer customized solutions that are tailored to your unique business needs and goals

Tech Trendsetters

We are always at the forefront of the latest industry trends and technologies

Stay Flexible

We are flexible and adaptable, able to adjust our approach to meet the evolving needs of our clients.

Achieve Together

We believe in building long-term relationship with our clients, working collaboratively to achieve shared goals and mutual success.

Trusted by brands from many different industries

Total members managed

Brands we’ve helped

Point issued

Our Clients

Our Partners

Our Solutions

Empower Your Brand with Custom Solutions that Fits Your Loyalty Needs

Design a loyalty program that works

Our team of consultants and data analysts will help formulize your loyalty program design and CRM strategy using data-driven insights.

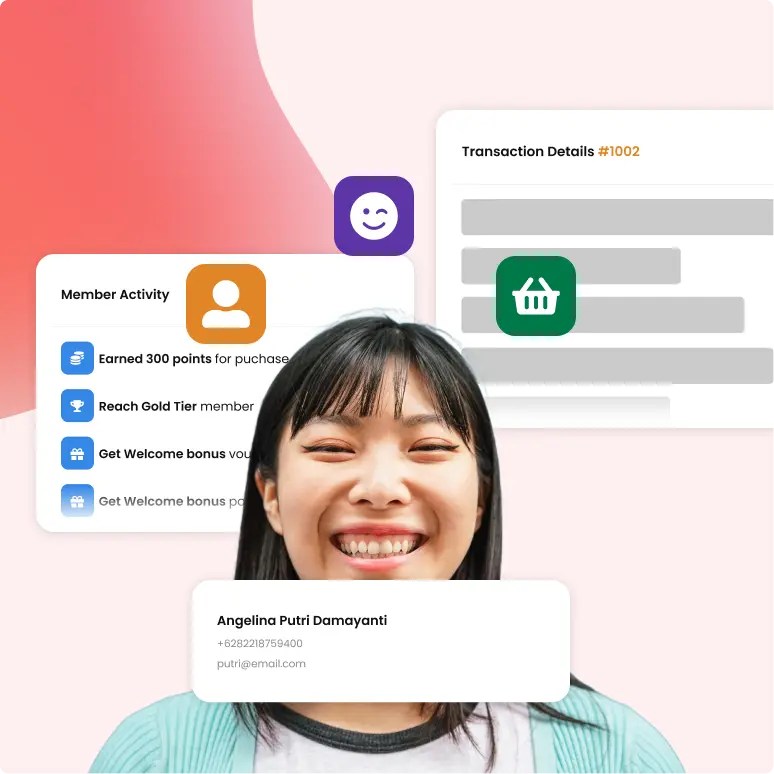

Build a custom loyalty platform

With a decade of experience, we're skilled in crafting efficient and effective loyalty platforms.

Boost your loyalty program engagement

Managing a loyalty program is more challenging than it may seem. Our consultant and data analyst team ensures you achieve optimal results.

Our Products

Elevate Customer Engagement with Trusted Solutions

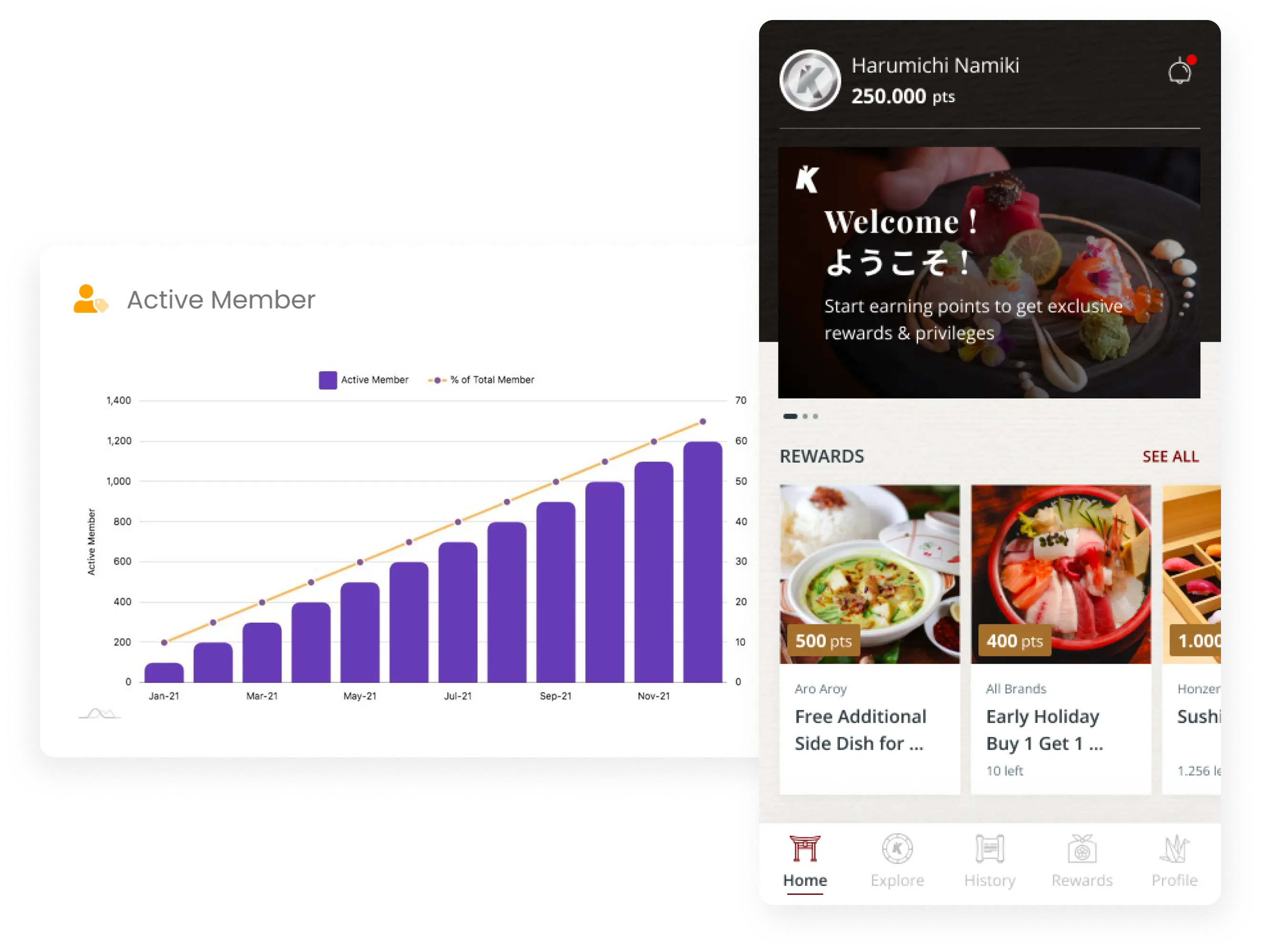

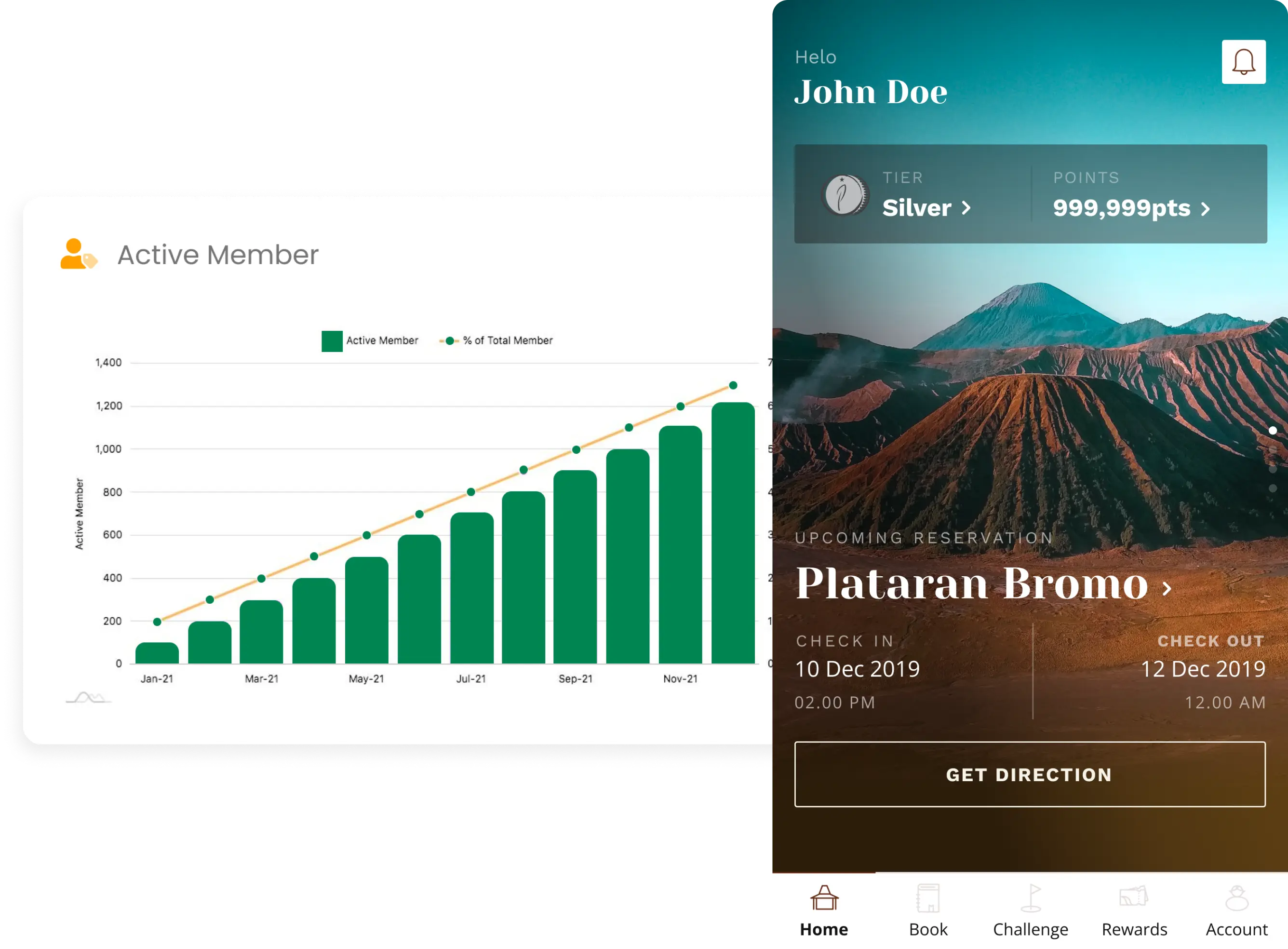

Loyalty Solution For Hotel

Hotelis is a loyalty solution designed for hotel groups with multiple properties. The platform is integrated to your booking engine and PMS, delivering a seamless experience for both your members and internal staff.

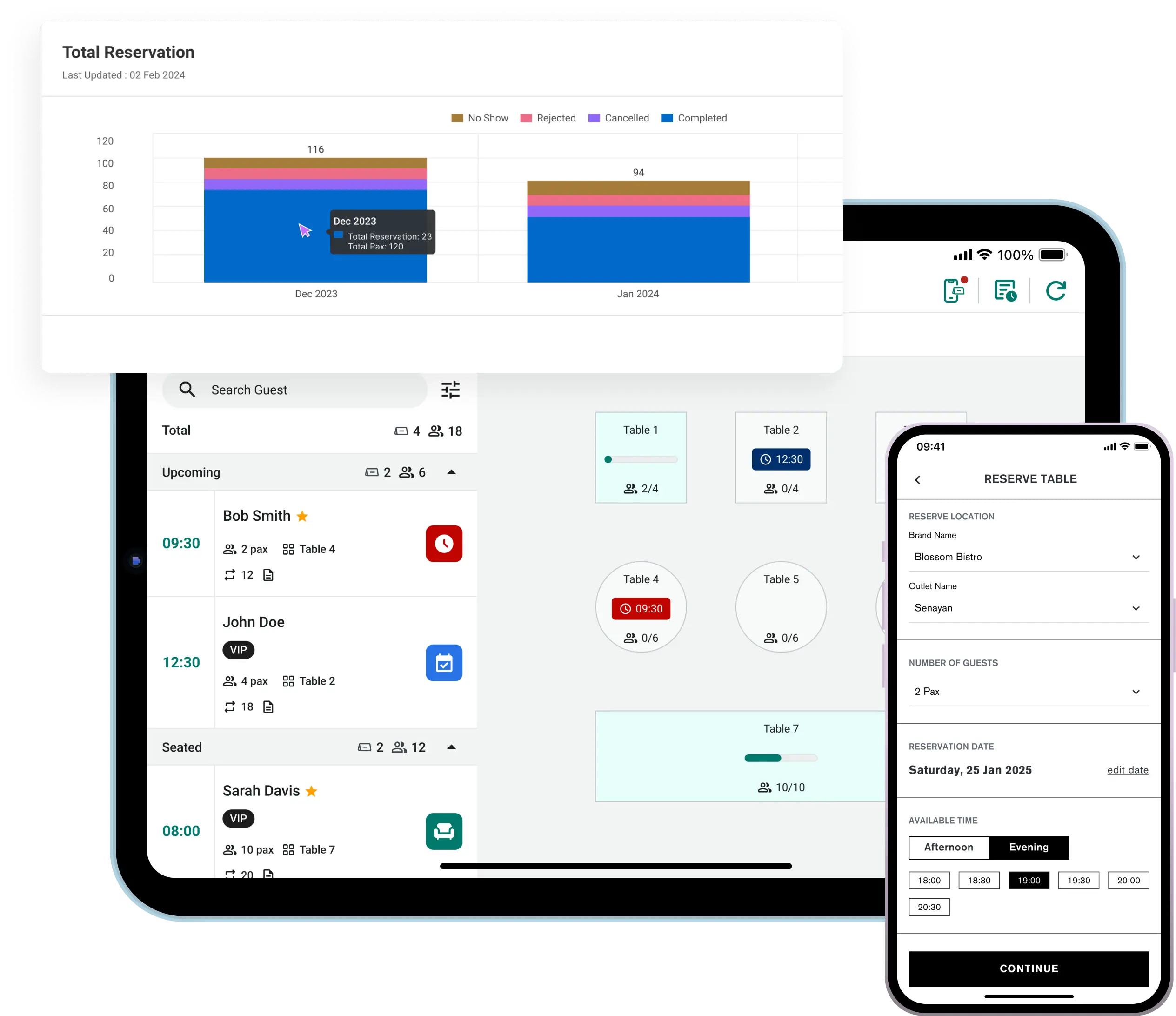

End-to-End Restaurant Reservation Solutions

Solva Reservation streamlines table bookings, improves guest satisfaction, and drives revenue growth with smarter management tools.